Compare Investment Accounts. Grayscale offers that prices are dictated by the market and not by Grayscale itself, so price fluctuations may be a result of supply and demand. Silbert has big plans for the Bitcoin Investment Trust, which is expected Join Stock Advisor. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. Related Articles. And don’t think that bitcoin will automatically come out on top because of its first-mover advantage and the fact that it’s the largest one.

Here’s how the market’s favorite tool for speculating on bitcoin’s price actually works.

It’s an imperfect how do i buy bitcoin investment trust to bet on bitcoin, but as the market’s only bitcoin fund, it snaps up a lot of trading volume. This trust acts biycoin a bitcoin fund of sorts, offering up the opportunity to bet on bitcoin by buying its shares. The trust owns bitcoins on its investors’ behalf, entrusting them tfust the cryptocurrency custody service Xapo to keep them safe. Each share currently represents ownership of approximately 0. Funds are never free to. It’s a relatively high management fee to pay, given gold ETFs charge as little as 0. Amusingly, it costs more to keep bitcoin safe than it does to keep gold safe.

Titled, auditable ownership through a traditional investment vehicle

Silbert has big plans for the Bitcoin Investment Trust, which is expected to open for public investors sometime in the fourth quarter of For the time being, the trust is a private investment vehicle but once it opens to the general public, the fund is expected to attract a new breed of bitcoin investors. Silbert explained the process and outlined his plans for BIT expansion in an interview with CoinDesk two weeks ago. These organisations are not designed with speculators in mind, however. Bitcoin investment funds are going after traditional investors who do not have a habit of entering unregulated markets and investing in speculative investment vehicles. It is still too early to say whether these funds can broaden the investor base and make digital currencies more appealing in traditional circles. Regardless of how much traction they get, they are likely to improve public perception among many who are reluctant to enter the niche.

What is the bitcoin investment trust?

Silbert has big plans for the Bitcoin Investment Trust, which is expected to open for public investors sometime in the fourth quarter of For the time being, the trust is a private investment vehicle but once it opens to the general public, the rtust is expected to attract a new breed of bitcoin investors. Silbert explained the process and outlined his plans for BIT expansion in an interview with CoinDesk two weeks ago.

These organisations are not designed with speculators in mind. Bitcoin investment funds are going after traditional investors who do not have a habit of entering unregulated markets and investing in speculative investment vehicles.

It is still too early to say whether these funds can broaden the investor base and make digital currencies more appealing in traditional circles. Regardless of how much traction they get, they are likely to improve public perception among many who are reluctant to enter the niche. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic trhst and abides by a strict set of editorial policies.

CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Read more about Disclosure Read More The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

Levine Dec 25,

Bitcoin — What You NEED To Know Before Investing in Bitcoin

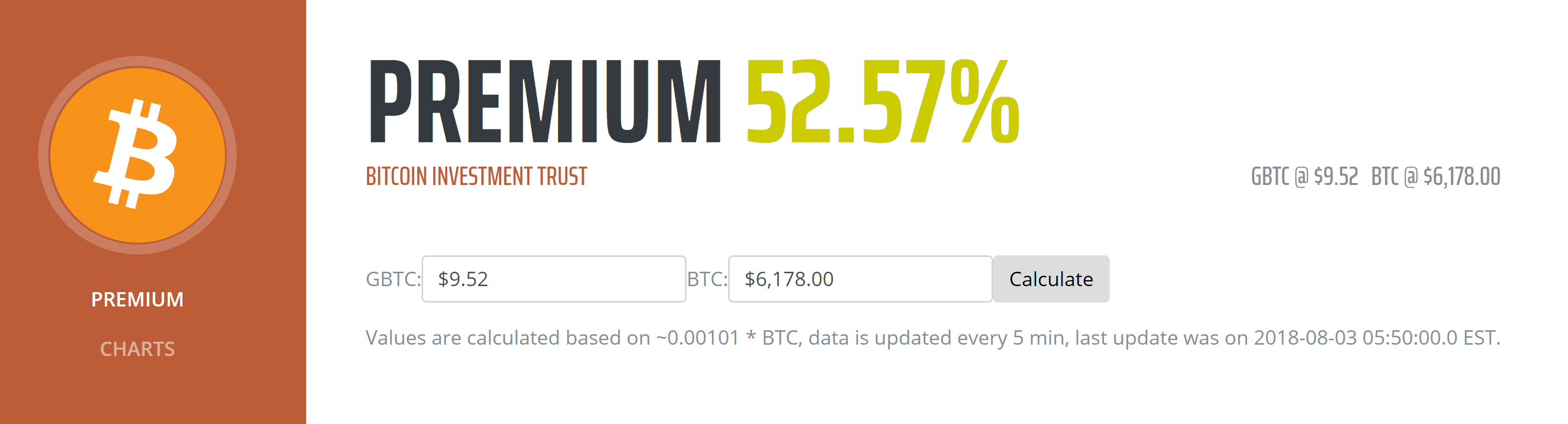

1. What is the Bitcoin Investment Trust (GBTC)?

Cryptocurrency Cryptocurrency ETF. Please enter your information below bbitcoin access: Investor Presentation Please note Grayscale’s Investment Vehicles are only available to accredited Investors. Popular Courses. In other words, the shareholders of the Bitcoin Investment Trust effectively own the company’s bitcoins, as they make up virtually all of its assets. Steeper declines could mean that shares could lose most or all of invwstment value. So, people who want to own bitcoin, but don’t want to directly purchase the cryptocurrency, are rather limited in their options. That means it would take more than 1, shares of GBTC to own one bitcoin. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency.

Comments

Post a Comment