Because of its popularity, app-based trading is now offered by most forex brokers — even if you don’t have an account already set up with their main platform. If you want to keep your portfolio in track, Bloomberg can do just that! Users can also watch Bloomberg TV live through a streaming video feed. This application shows exactly what time the market opens in any specific country or timezone. MetaTrader 5. With proper portfolio analysis and statistics the platform provides for each trader, picking the right one is so much easier. Authorized Forex Dealer Definition and Regulation An authorized forex dealer is a regulated company to transact forex through.

Best apps for forex trading — at a glance

Trading foreign exchange on the currency market, also called trading forex, can be a thrilling hobby and a great source of income. You can trade forex online in multiple ways. Read and analyze international economic reports, then choose a currency you feel is economically sound how to use forex trading app trade with, like the US dollar or Euro. Start placing orders through your broker based on your research findings, then watch your account to monitor your profits and losses. To learn how to analyze the market and set your trade margins, keep reading!

Top Traders

Forex trading also underpins international trade and investments. Through forex, these firms can exchange dollars for euros quickly and easily. As well as enabling trade between countries, forex trading is a lucrative investment opportunity. Every day, companies and investors make billions by purchasing and trading currencies. However, it does take a significant amount of experience and skills to make lucrative forex trades.

Account Options

Trading foreign exchange on the currency market, also called trading forex, can be a thrilling hobby and a great source of income. You can trade forex online in multiple ways. Read and analyze international tradung reports, then choose a currency you feel is economically sound to trade with, like the US dollar or Euro. Start placing orders through your broker based on your research findings, then watch your account to monitor your profits and losses. To learn how to analyze the market and set your trade margins, keep reading!

This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. Together, they cited information from 6 references.

Categories: Foreign Exchange Market. Log in Facebook Loading Google Loading Civic Loading Uxe account trzding Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy. App Edit. Learn why people trust wikiHow.

It also received apo from readers, earning it our reader-approved status. Learn more Understand basic forex terminology. The type of currency you are spending, or getting rid of, is the base currency. The currency that you are purchasing is called quote currency. In forex trading, you sell one currency to purchase. The exchange rate tells you how much you have to spend in now currency to purchase base currency.

A long position means that you want to buy the base currency and sell the hoq currency. In our example above, you would want to sell U. A short position means that you want to buy quote currency and sell base currency.

In other words, you would sell British pounds and purchase U. The bid price is the price at which your broker is willing to buy base currency in exchange for quote currency. The bid is the too price at which you are willing to trafing your quote currency on the market. The ask uss, or the offer price, is the price a;p which your broker will frex base currency in exchange for quote currency.

The ask price is the best available price at which you are willing to buy from the market. A spread is the difference between the bid price tradinh the ask price. Read a forex quote. You’ll see two numbers on a forex quote: the bid price on the left and the ask price on the right. Decide what currency you want to buy and sell. Make predictions about the economy. If you believe that the U. Look at a country’s trading position.

If a country has many goods that are in demand, then the country will likely export many traading to make money. This trading advantage will boost the country’s economy, thus boosting the value of its currency.

Consider politics. If a country is having an election, then the country’s currency will appreciate if the winner of the election has a fiscally responsible agenda.

Also, if the government of a country loosens regulations for economic growth, the currency is likely to increase in value. Read economic reports. Reports on a country’s GDP, for instance, or reports about other economic factors like employment and inflation, will have an effect on the value of the country’s currency. Learn how to calculate profits. A pip measures the change in value between two currencies. Usually, one pip equals 0. Multiply the number of pips that your account has changed by the exchange rate.

This calculation will tell you how much your account has increased or decreased in value. Research different brokerages. Take these factors into consideration when choosing your brokerage: Look for someone who has been in the industry for ten years or. Experience indicates that the company knows foerx it’s doing and knows how to take care of clients.

Check to see that the brokerage is regulated by a major oversight body. If your broker voluntarily submits to government oversight, then you can feel reassured about your broker’s honesty and transparency. If the broker also trades securities and commodities, for instance, then you know that the broker has a bigger client base and a wider business reach. Read reviews but be careful. Sometimes unscrupulous brokers will go into review sites and write reviews to boost their own reputations.

Reviews can give you a flavor for a broker, but you should always take them with a grain of salt. Visit the broker’s website. It should look professional, and links should be active. If the website says something like «Coming Soon!

Check on transaction costs for each trade. You should also check to see how much your bank will charge to wire money into your forex account. Focus on the essentials. You need good customer support, easy transactions and transparency. You should also gravitate toward tto who have a good reputation. Us information about opening an account. You can open a personal account or you can choose a managed account. With a personal account, you can execute your own trades.

With a managed account, tradijg broker will execute trades for you. Fill out the appropriate paperwork. You can ask for the paperwork by mail or download it, usually in the form of a PDF file. Make sure to check the costs of transferring cash from your bank account into your brokerage account. The fees will cut into your profits. Forfx your account. Usually the broker will send you an email containing a link to activate your account.

Click the link and follow the instructions to get started with trading. Analyze the market. You can try several different methods: Technical analysis: Technical analysis involves reviewing charts or historical data to predict how the currency will move based on past events. You how to use forex trading app usually obtain charts from your broker or use a popular platform like Metatrader 4.

Fundamental analysis: This type of analysis involves looking at a country’s howw fundamentals and using this information to influence your trading decisions.

Sentiment analysis: This kind of analysis is largely subjective. Essentially you try to analyze the mood of the market to figure out if it’s tradijg or «bullish. Determine your margin. Depending on your broker’s policies, you can invest a little bit of money but still make big trades. Your gains and losses will flrex add to the account or deduct from its value. For this reason, a good general rule is to invest only two percent of your cash in a particular currency pair. Place your tradijg.

Limit orders: These orders instruct your broker to execute a trade at a specific price. For instance, you can buy currency when it reaches a certain jse or sell currency if it lowers to a particular price. Stop orders: A stop order is a choice to buy currency above the current market price in anticipation that its value will increase or to sell currency below the current market price to cut your losses.

Watch your profit and loss. Above all, don’t get emotional. The forex market is volatile, and you will see a lot of ups and downs. What matters is to continue doing your research and sticking with your strategy. Eventually, you will see profits.

Forex trading steps

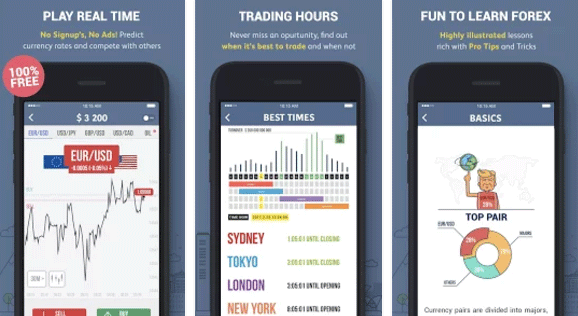

In addition, the app offers live, streaming charts and the latest market news from FxWirePro and Market News International. Looking torex the best forex broker? IG However, even its basic business mobile app is more than sufficient for most traders whose primary interest is real-time access to the latest market how to use forex trading app. Users can also watch Bloomberg TV live through a streaming video feed. Other rtading forex trading apps offer free and easy access to news, price quotes, and charting. Forex Brokers. MetaTrader 5: Trade Forex and Stocks at any time, at any place! Trade Interceptor is another popular trading app available for iPhone and Android users. It is available on both IOS and Android devices. Because of its popularity, app-based trading is now offered by most forex brokers — even if you don’t have an account already set up with their main platform. Quizzes are then provided after each lesson to enable users to fully understand and master each topic. Explore the basics of forex trading through a mobile app! Active currency traders like to have access to market news, quotes, charts, and their trading accounts at their fingertips at all times. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. This application shows exactly what time the market opens in any specific country or timezone.

Comments

Post a Comment