Try Unocoin and Zebpay. When you register on Wirex and complete you KYC you get access to a crypto linked bank account. Yes, there are many services you can use to buy bitcoin with a credit card. In your 30s? Benzinga Money is a reader-supported publication.

Your step-by-step guide to buying bitcoin and other cryptos with a credit or debit card.

Morgan ChaseBank of America and Citigroup said Friday they are no longer allowing customers to buy cryptocurrencies chhase credit cards. The high-flying digital currency had rallied 2, percent in just 12 months to reach that record. Other cryptocurrencies have also fallen in the last few weeks after soaring, sometimes even far more than bitcoin, last year. A Bank of America spokesperson also said in an email that the bank has decided to decline credit card purchases of cryptocurrencies. Citigroup said in a statement that it has «made the decision to no longer permit credit card purchases of cryptocurrency. We will continue to review our policy as this market evolves.

How to buy bitcoin

Last updated: 18 December We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. But how and where do you buy crypto with a credit or debit card, and are there any traps you should avoid? Keep reading to find out.

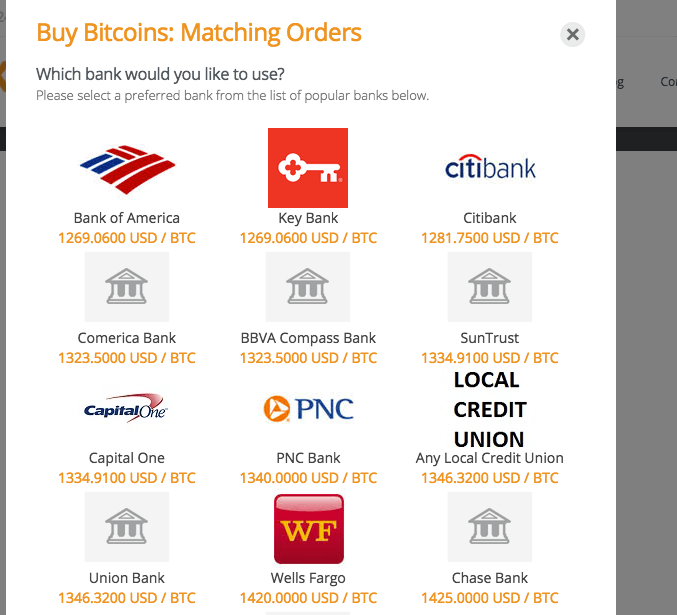

How to buy Bitcoins with Chase Quickpay

Ask an Expert

Copy link. Whereas wire transfer nill charge. Open an account with Benzinga’s best online broker, TD Ameritrade. Even as Bitcoin becomes more widely known, it’s not widely accepted in many traditional case retailers. Many companies and industries that are wary of the staying power of cryptocurrencies are also very interested in the potential of blockchain technology. Our buh cushion made it bearable. Although Zebpay is mobile application…Unocoin has both webpage as well as App. Want to invest your spare cash? Kabir I found Bitcoin panda price to be high. Time to grow up your finances.

Comments

Post a Comment